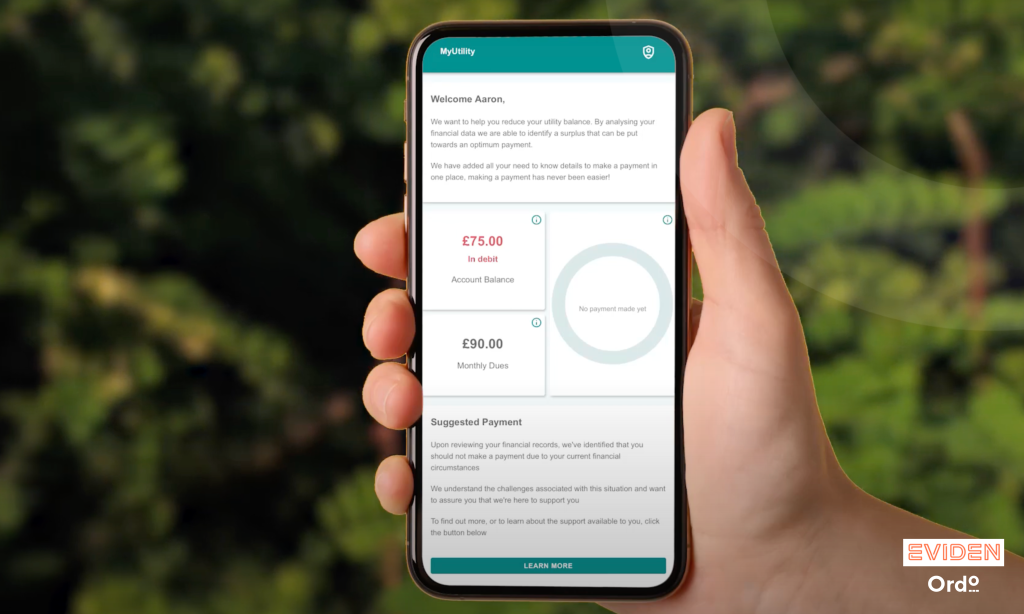

Breaking News: introducing flexible bill payments, designed to tackle real-life financial challenges

Let’s face it: paying bills is one of life’s inevitabilities. But it shouldn’t come with unnecessary headaches. That’s why we at Ordo, alongside Eviden (an Atos Group company) and blockchain expert ByzGen, are piloting a flexi-payment service to make bill payments work for everyone—not just those with a perfect bank balance. Bills made for real life Our new […]

Ordo’s shortlisted for the FinTech50! 🚀

Ordo has been shortlisted for the FinTech50, recognising 181 UK companies that are reshaping the future of finance and payments. We stand by the power of our solutions—driving financial inclusion and helping businesses save over 80% on payment fees, offering a viable alternative to the dominance of traditional payment methods like cards. Your vote supports the […]

What Open Banking means for Consumers: the Good and the Bad

The rise of Open Banking in recent years has radically reshaped the financial services industry, using novel APIs (Application Programming Interfaces) from third-party developers to offer flexible solutions to improve the connections between financial institutions, retailers, service providers, and their customers. But what are the advantages and disadvantages of Open Banking? The benefits of improved […]

Unlocking the potential of Open Banking. The regulatory drivers | Variable Recurring Payments: Are you ready for what’s to come?

Response to HM Treasury’s Consultation on improving the effectiveness of the anti-money laundering regulations

The rise of Giving 2.0: How Open Banking is changing charitable giving

The impact of Open Banking donations Simple, swift, and secure, Open Banking technology has revolutionised fundraising and charitable giving in recent years. The rise of customised financial APIs makes it straightforward for charities to boost personal donations with instantly transferred account-to-account (A2A) payments, simultaneously reducing overhead costs. Traditional methods, such as card payments or direct debits, take […]

JROC Future Entity consultation response – 20 May 2024

The role of APIs in Open Banking ecosystems

Navigating the financial frontier: role of APIs in Open Banking Open Banking is radically reshaping the financial ecosystem for individuals and institutions alike, enabled by the successful development and introduction of financial APIs (application programming interfaces). APIs in banking allow you to share your personal financial data with the organisations offering you the products and […]

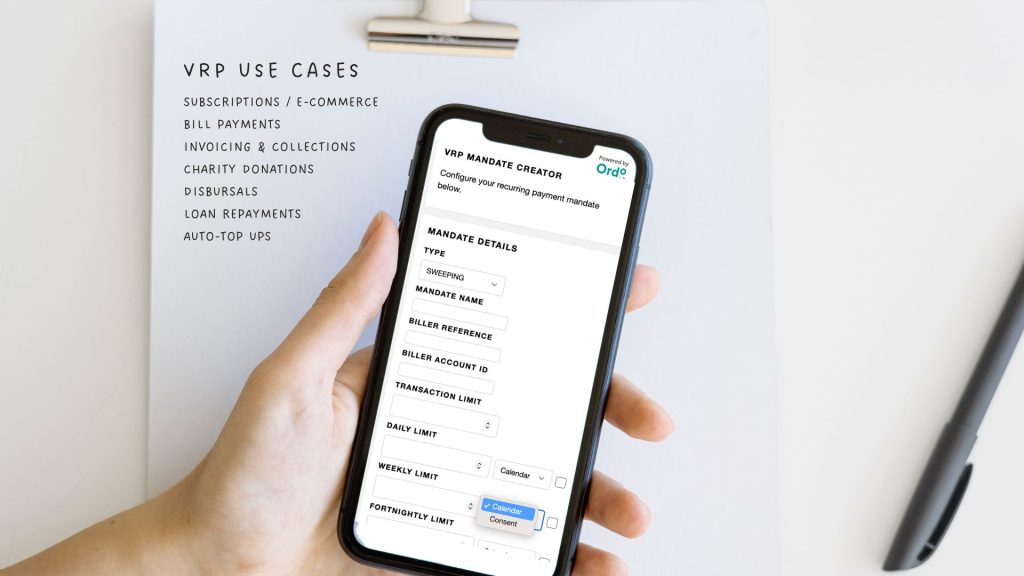

Unlocking the potential of Open Banking | Variable Recurring Payments Phase 1

Why the Payment Systems Regulator, as part of the Joint Regulatory Oversight Committee, is planning regulatory intervention

How Open Banking benefits E-commerce

As E-commerce continues to grow its share of the UK retail market (26.5% and rising), Open Banking technology is at the forefront of product innovation and market development.

Comparison of Variable Recurring Payments (VRP) to Fixed Payments

Variable Recurring Payments (VRP) use modernising Open Banking technologies to enhance transaction experiences for businesses and consumers, with several key advantages.

The future of Variable Recurring Payments: trends and innovations

Discover the future of variable recurring payments in the ever-evolving banking landscape. Explore emerging trends, technological advancements, enhanced security measures, regulatory compliance, and the rise of the subscription economy in this insightful blog.

What are the benefits of Variable Recurring Payments (VRP) and why are they gaining momentum?

Variable Recurring Payments (VRP) use modernising Open Banking technologies to enhance transaction experiences for businesses and consumers, with several key advantages.

Adapting to change: From traditional to transformational account-to-account (A2A) payments

Rapid developments in Open Banking have led to a revolution in payment services, delivering transformational customer-focused changes for account-based transactions

Open Banking donations: Cutting through fees to channel more to those in need

The emergence of Open Banking is profoundly impacting the charity sector by reducing transaction fees, improving access and reach, strengthening donor streams and enhancing the donor journey. Open Banking donations benefit from increased transparency, offering donors more clarity in how their funds are spent and building trust and confidence in their chosen charity’s performance.

Plug-and-Play payments: A quick and secure way for businesses to reduce their payment processing fees – and regulatory burden

About Plug-and-Play payments As the competitive environment continues to accelerate, it has never been more critical for businesses to maximise revenues and reduce transaction costs. Forward-looking businesses use “Plug-and-Play” payments to simplify payment processing fees, seamlessly integrating online payments into the customer journey without significant technological adaptation. Fintech innovations such as Plug-and-Play use API technology, […]

Bridging the gap: Leveraging Open Banking for inclusive lending – from smart borrowing to real-time disbursals

Open Banking offers many new opportunities across the lending landscape, with financial APIs delivering novel solutions and increasing inclusivity. The growth of inclusive lending is powered by the secure sharing of additional data sources like utility bills and rent payments. These facilitate alternative credit scoring, swifter decision-making processes and the creation of highly personalised financial […]

PSR Consultation CP23/12: Expanding Variable Recurring Payment

The future of banking: How API Technology is revolutionising the industry

API (Application Programming Interface) technology is revolutionising the banking industry, significantly changing how individuals and institutions interact. It offers your organisation instantaneous collaboration and greater connectivity, making cross-border transactions more efficient and convenient. API banking technology is transformational and innovative, enhancing customer experiences and increasing data security in several ways: So, it’s essential to understand […]

The evolution of digital banking: The next chapter in the evolution of fintech

After centuries of rigid protocols and traditional techniques, the banking industry has undergone a radical transformation powered by the rapid rise of digital banking. With access no longer restricted by the need to visit a physical branch during business hours, innovative fintech solutions have quickly revolutionised how we handle our finances. Over the last thirty […]

Revolutionising the World of Finance: Exploring the power of financial innovation

1. Introduction Financial Innovation is revolutionising the world of finance with the rapid development and delivery of novel financial services and products. API integration in banking enables greater specialisation and personalisation, while Open Banking technology improves accessibility and creates consumer confidence in digital banking. That means individuals and businesses can benefit from bespoke banking services more tailored to their needs. […]

The Future of Banking: How API Technology is revolutionising the industry

1. Introduction API (Application Programming Interface) technology is revolutionising the banking industry, significantly changing how individuals and institutions interact. It offers your organisation instantaneous collaboration and greater connectivity, making cross-border transactions more efficient and convenient. API banking technology is transformational and innovative, enhancing customer experiences and increasing data security in several ways: So, it’s essential […]