Low cost, secure Open Banking Variable Recurring Payments solutions moving money in real time, with minimum friction, whilst giving payers the degree of control they’re craving

Fully hosted cloud service with bank grade security, accessed via single API integrated within weeks.

Turn-key solution that handles all the tech, whilst you concentrate on your business.

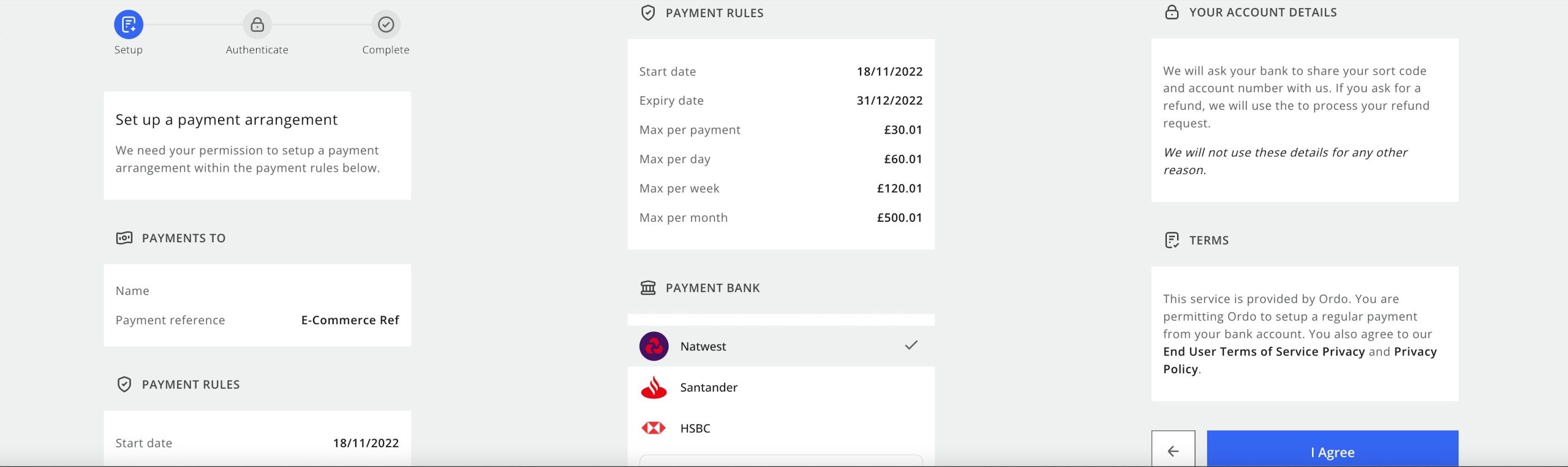

White-labelled end-to-end payment flows and automatic referencing including secure URL tokenised links and an optional redirect URL .

Collect repeated payments from customers under a single agreement – like a direct debit but dynamically flexible, with set up in minutes and instant payment. Amounts, frequency and oversight level can be altered, with agreement between business and payer, without having to cancel the relationship, meaning parties can dynamically respond to life’s changes: useful for businesses and helpful for consumers.

VRP comes with all the benefits of Request to Pay’s lower costs, the liquidity boost of immediate payment, greater security, enhanced customer experience and irrevocable payment, it is must have functionality for businesses collecting repeated payments be it via subscription, standing orders, hard to track single repeated payments and for those customers unwilling to pay by direct debit.

Ordo hosts, securely manages and coordinates all the complexity of payments and handles the heavy lifting open banking tech so you get paid effortlessly, and at low cost.