Open banking made easy

A new generation of financial solutions, powered by open banking, tailored for you.

Get in touchWhat we offer

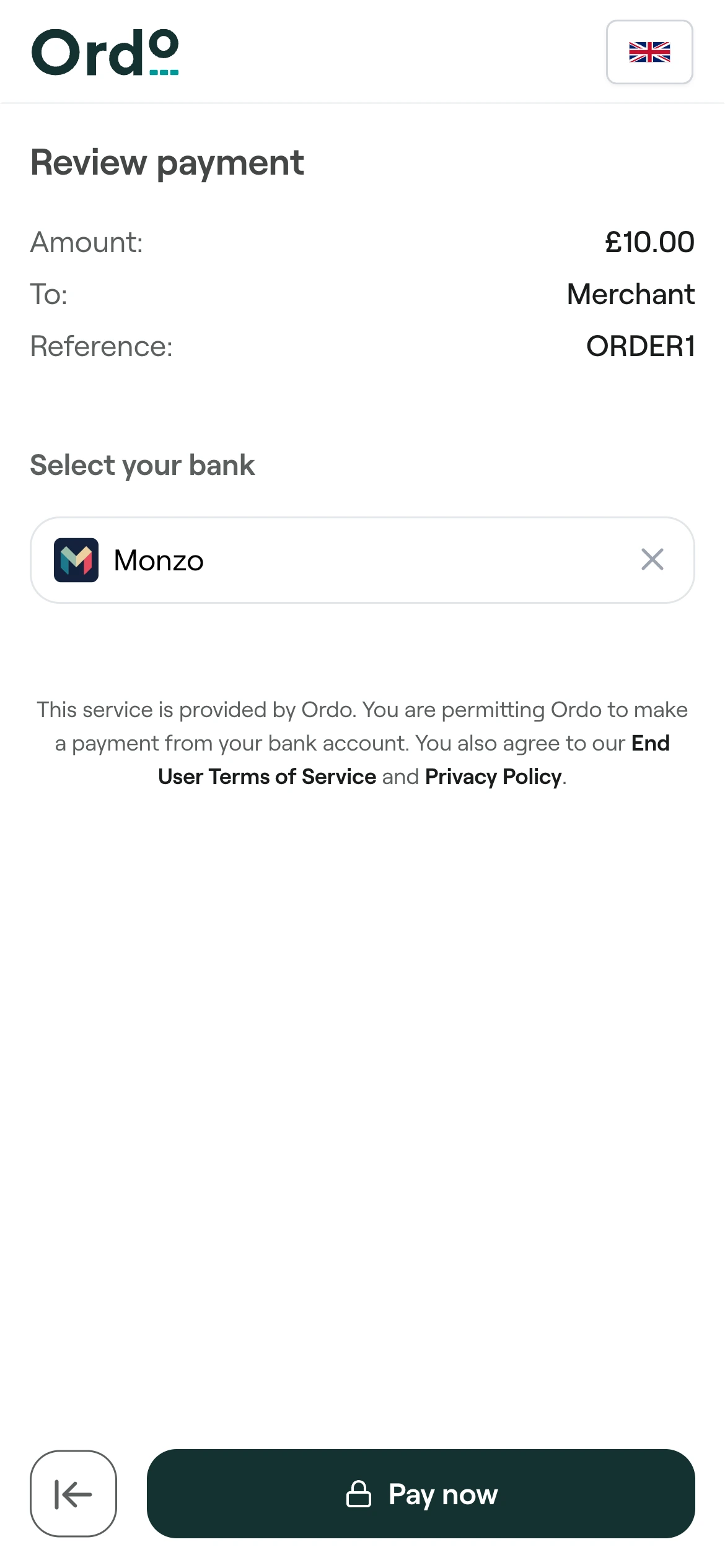

Payments

Powered by open banking, we provide a simple and secure way to Pay by Bank that your customers will love. Make it yours with your branding.

Account Data

Integrate reliable financial data into your products via our robust and expansive PSD2 API platform.

Variable Recurring Payments

Low cost and secure, Variable Recurring Payments allow movement of funds in real time, with minimal friction, giving payers the degree of control they're craving.

Verify

Powered by open banking, we provide a simple and secure way to Pay by Bank that your customers will love. Make it yours with your branding.

Instant Payouts

Send funds to customers instantly, not in days. Our solution enables immediate bank transfers, improving cash flow and customer satisfaction.

Quick Integration

Integrate our solutions into your existing systems with minimal effort. Our developer-friendly APIs and comprehensive documentation make implementation fast and straightforward.

Effortless payment solutions

Lower Cost

Certainty of Payment

More Efficient

Instant

Reduced Regulatory Burden

Easy to Integrate

Secure

Easy to Use

Open Banking 2025

Everything you need to know about open banking and how it can help your business in 2025 and beyond.

Download now

It's never been easier to add open banking to your solution

Let's chat and find the perfect solution for you.

Get started in minutes

Trusted by leading banks

Seamlessly connect with your customers' existing banking relationships through our extensive network of integrated financial institutions.

Connect to our API

Powerful building blocks for your own financial services

Integrate Payments

Enable direct bank payments in your app or website via our open banking API - for licensed AIS/PIS providers.

Integrate Data

Integrate reliable financial data into your products via our robust and expansive PSD2 API platform.