Enjoy secure transactions, convenient options, and automated billing for hassle-free processing

Paying bills shouldn’t be a headache. That’s where we step in with our expertise to shake things up, making the whole process more convenient, secure, and cost-effective.

Play Video

Play Video

No more repetitive collection of account information for each biller with Ordo.

Ordo includes enhanced remittance data in every payment for transparent transactions.

Enjoy real-time transactions with Ordo, eliminating batch processing and delays.

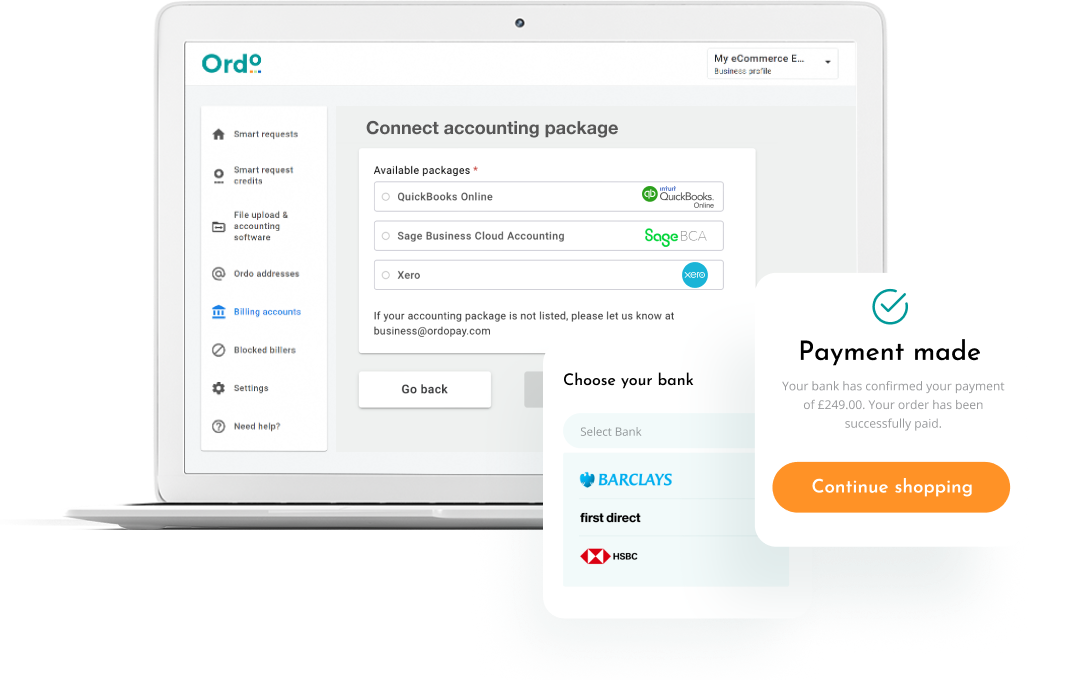

Ordo seamlessly integrates into accounting systems, offering a comprehensive billing solution.

Explore a variety of seamless methods to request payments effortlessly. Collect payments with ease by providing secure tokenised links or QR codes through emails, WhatsApp messages, kiosks, in-stores, or by post.

Streamline payments by securely attaching invoices to the payment request, offering customers transparent details of the goods or services for efficient processing.

Eliminate the need for your customers to set up new payee details. With a simple click on the link or a scan of the QR code, customers can seamlessly log into their bank, where the payment is pre-set – no typing required. Eradicate fraud risk and ensure unparalleled convenience!

Stay in the know with real-time transaction updates! Ordo notifies you in real-time of the payment status. Once authorised, there’s no more waiting days for funds to settle—with Ordo, transactions are settled in real-time, 24×7.

Securely capture bank account details from the beginning to facilitate precise refunds and pay-outs, all with your customer’s consent. This guarantees accuracy, providing enhanced security and operational efficiency.

Ensure correct amounts with prepopulated fields, saving time, effort, and reducing mistakes to enhance the user experience. Say goodbye to countless hours spent on reconciliations!

Leverage bank-grade security, avoid storing card details, and initiate payments securely.

Receive reconciled payments directly, saving your business thousands of hours per year.

Avoid third-party fees and benefit from bank fee rebates with solutions like Ordo.

Maintain an audit trail for invoices and payment confirmations. No requirement for PSD2 or PCI DSS compliance!

Optimise working capital with real-time 24×7 bank transfers, via the Faster Payments network, cheaper than card payments.

Include key metadata like invoice numbers and attachments.

Initiate payments directly within your invoice management software with secure tokenised links or through QR codes.

Absolutely. All payment fees are capped at 20p + VAT, and there’s no per-transaction fee whatsoever. This results in considerably lower costs than most card and payment providers like Paypal, Stripe, GoCardless, iZettle and SumUp.

Organisations that process high volumes of transactions are eligible to receive a payment fee discount. Enterprise clients save even more when they switch to Ordo.

To discuss your organisation’s requirements, simply book a demo or contact our sales team today.

Ordo is an Open Banking payments platform that reduces the cost of accepting payments, making it easier for customers to pay.