In today’s rapidly evolving digital landscape, variable recurring payments (VRP) have emerged as a powerful tool in the realm of financial services. VRP payments offer flexibility and convenience for both businesses and consumers, allowing for adaptable payment structures and low-cost transactions. Leveraging the advancements in Open Banking and mobile payments, VRP has revolutionised the way businesses collect payments and customers manage their financial obligations.

In this blog, we will delve into the world of VRP, exploring its benefits, impact on low-cost payments, and its role in transforming the financial services landscape.

The Power of Variable Recurring Payments

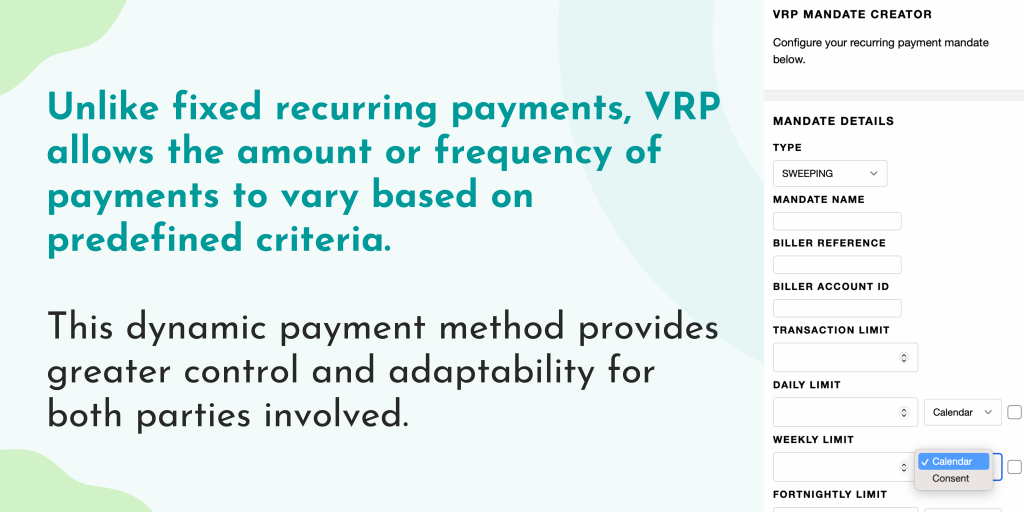

Variable recurring payments (VRP) empower businesses and consumers with the ability to create flexible payment structures tailored to their unique needs. Unlike fixed recurring payments, VRP allows the amount or frequency of payments to vary based on predefined criteria. This dynamic payment method provides greater control and adaptability for both parties involved.

For businesses, VRP enables them to align payment schedules with variable factors such as changing subscription plans, usage-based services, or even seasonal fluctuations. This flexibility enhances cash flow management and reduces the administrative burden of manual payment adjustments. By offering VRP, businesses can attract a wider customer base and increase customer satisfaction by accommodating diverse payment preferences.

Similarly, consumers benefit from VRP by gaining more control over their financial commitments. With VRP, they can align payments with their budget and consumption patterns. For instance, utility bills or insurance premiums can be adjusted based on actual usage, resulting in fair and accurate payments. Additionally, VRP offers convenience, as customers no longer need to remember to make manual payments, as the system automatically deducts the correct amount at the appropriate intervals.

Low Cost Payments with VRP and Open Banking

VRP payments go hand in hand with the concept of low-cost payments, revolutionising the traditional banking landscape. Open Banking, a system that enables secure data sharing between financial institutions and authorised third-party providers, has paved the way for more cost-effective payment solutions, including VRP.

By leveraging Open Banking APIs, businesses can integrate their systems with various financial service providers, streamlining payment processes and reducing transaction costs. VRP, in conjunction with Open Banking, facilitates real-time payment authorisations, eliminating the need for intermediary systems or costly transaction fees associated with traditional payment methods. This results in significant savings for businesses and encourages the adoption of low-cost payment alternatives.

Moreover, VRP enables businesses to offer customised pricing structures and incentives to customers, leading to higher customer loyalty and retention. By analysing customer data and behaviour through Open Banking, businesses can identify opportunities for personalised payment plans, tailored promotions, and targeted marketing strategies.

The Rise of VRP and Mobile Payments

The ubiquity of smartphones and the increasing popularity of mobile payment solutions have further propelled the adoption of VRP. Mobile payments, such as mobile wallets or payment apps, offer convenience and accessibility, enabling users to manage their VRP effortlessly on-the-go.

With VRP integrated into mobile payment solutions, customers can easily set up and manage their recurring payments directly from their mobile devices. This convenience fosters a seamless payment experience and encourages timely payments, reducing instances of delinquencies and defaults.

Furthermore, the combination of VRP and mobile payments opens up new avenues for financial inclusion. VRP allows individuals who may not have access to traditional banking services to participate in digital transactions and enjoy the benefits of flexible payment options. This inclusion contributes to a more inclusive and equitable financial ecosystem.

Variable Recurring Payments (VRP) have revolutionised the financial services industry, offering businesses and consumers the flexibility and convenience they desire. By leveraging VRP, businesses can create adaptable payment structures, optimise cash flow, and attract a broader customer base. Additionally, the integration of VRP with Open Banking and mobile payments has paved the way for low-cost, secure, and inclusive payment solutions. As the world continues to embrace digital transformation, VRP will undoubtedly play a pivotal role in shaping the future of financial services, empowering individuals and businesses alike.