Expanding payment options is more than just a convenience: it represents a strategic decision capable of significantly influencing a business’s success.

Providing different payment methods in today’s rapidly evolving digital landscape empowers enterprises to elevate customer convenience, amplify sales, and strengthen their competitive stance in the dynamic and diverse contemporary market.

Enters Ordo’s ground-breaking ‘Payments as a Service’ solution – a turnkey offering meticulously designed to redefine the realm of Payments by leveraging Open Banking expertise. Rooted in an unyielding commitment to security, Ordo’s service, artfully curated by a team of seasoned payments professionals (including the former leadership team of Faster Payments), presents an array of seamless payment solutions. These not only elevate customer convenience but also stand out as a more cost-effective alternative when contrasted with traditional payment methods like card payments burdened with fees and rigid direct debits.

Ordo offers a range of cutting-edge payment options to meet the current innovation demands of the market. From One off to Variable Recurring Payments and QR codes, Ordo provides a diverse array of options to streamline transactions and enhance the overall payment experience.

In this blog, we’ll explore:

- Open Banking Payments Platform-as-a-Service: the foundation of Ordo’s different payment options

- Request to Pay (RtP): a flexible and instant way to bypass cards and slash fees

- Variable Recurring Payments (VRP): the intelligent direct debit solution for automating regular payments, featuring instant setup

- E-Commerce and QR Codes: seamless online and in-person payments

- Single or Repeated Payments: tailored to your needs

- Secure tokenised links and Pay Now buttons: safe and easy payments

- Open Banking Payment Initiation: the payment steps

- API Integration and white-labelled screens: customising Ordo for your business

Open Banking Payments Platform-as-a-Service (PaaS): the foundation of Ordo’s different payment options

At the core of Ordo’s offerings lies the concept of Open Banking Payments Platform-as-a-Service (PaaS). As a cloud-based platform, Ordo’s PaaS provides integrated tools and automated infrastructure to facilitate the seamless development and delivery of Open Banking payment solutions. Open Banking allows third-party providers, like Ordo, to access financial data and initiate payments securely through through Application Programming Interfaces (APIs). This framework empowers businesses to integrate Ordo’s services seamlessly into their existing systems, unlocking a host of innovative payment solutions.

With Open Banking Payments Platform-as-a-Service (PaaS), Ordo acts as a comprehensive platform catering to diverse payment needs. It offers a unified and efficient infrastructure that facilitates the delivery of multiple payment methods while handling the underlying infrastructure management. This enables businesses to deliver Open Banking payment innovation faster, without managing servers or resources, saving businesses valuable time and resources.

Request to Pay: a flexible and instant way to bypass cards and slash fees

Request to Pay (RtP) is a versatile different payment option provided by Ordo. It enables businesses and individuals to request payments directly from their customers. This approach enhances convenience for all parties involved, as customers receive clear and itemised payment requests, making settlement quick and straightforward. RtP is particularly advantageous for businesses that deal with variable amounts or customised billing cycles.

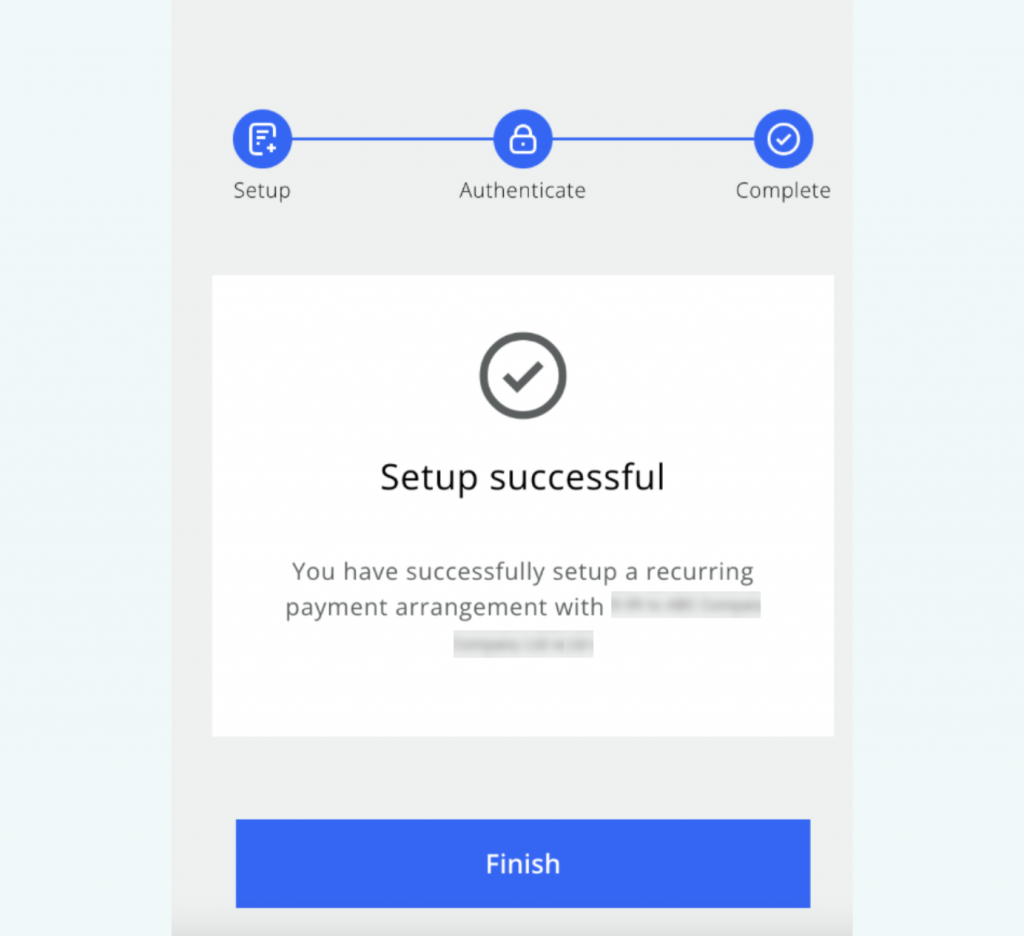

Variable Recurring Payments (VRP): the intelligent direct debit solution for automating regular payments, featuring instant setup

Ordo’s Variable Recurring Payments (VRP) feature is ideal for businesses that rely on periodic billing. VRP automates the process of charging customers at different intervals while allowing flexibility to adjust payment amounts as necessary. This functionality is especially useful for subscription-based services, utility companies, and membership organisations, streamlining their payment processes and improving cash flow management.

E-Commerce and QR Codes: seamless online and in-person payments

With the exponential growth of e-commerce, having secure and hassle-free online payment is vital for businesses. Ordo offers a user-friendly E-Commerce integration that allows seamless and secure transactions on various digital platforms. Customers can conveniently complete their purchases without the need to enter their payment details repeatedly.

Furthermore, Ordo’s incorporation of QR codes provides a swift and contactless payment experience, whether it’s in brick-and-mortar stores, events, or delivery services. By scanning the QR code, customers can instantly make payments, enhancing the efficiency of point-of-sale transactions.

Single or Repeated Payments: tailored to your needs

Ordo caters to a wide range of payment preferences, including both single and repeated payment options. Whether it’s a one-time transaction or a recurring charge, the platform offers intuitive payment flows to accommodate the unique requirements of businesses and individuals. This flexibility ensures that Ordo can adapt to various use cases, providing a seamless experience for users.

Secure tokenised links and Pay Now buttons: safe and easy payments

Security is paramount in the digital payment realm. Ordo addresses this concern with Secure Tokenised Links and Pay Now Buttons. These features generate unique, one-time tokens for each transaction, ensuring that sensitive data remains protected. Customers can complete payments through secure channels, minimising the risk of unauthorised access to their financial information.

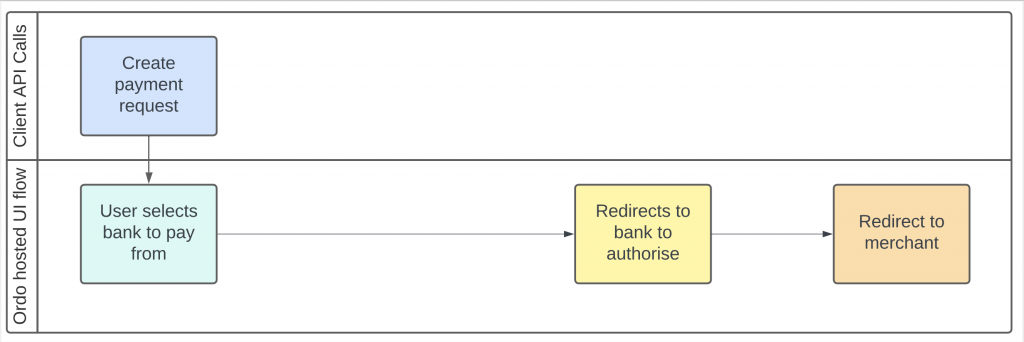

Open Banking Payment Initiation: the payment steps

Understanding the nuances of initiating Open Banking payments unveils invaluable insights into the streamlined and secure process underpinning this innovative approach, where payments occur faster and at lower costs – all without the need for customers to input their card or bank details.

This section provides a concise breakdown of the steps involved in Open Banking payment initiation. Remarkably, these steps transpire within milliseconds, exemplified by an Open Banking checkout with Ordo that typically concludes in less than a minute:

- Customer consent: The customer agrees to an Open Banking payment, permitting a third-party provider like Ordo to access their financial data.

- Secure data retrieval: The provider securely accesses the customer’s financial information, including account details and available funds, using standardised APIs.

- Payment initiation: With data in hand, the provider initiates the payment, transmitting recipient details and transaction amount.

- Real-time verification*: The customer’s bank verifies the payment details, ensuring funds and transaction legitimacy, and notifying both parties.

- Transaction completion: Upon verification, funds are transferred from the customer’s account to the recipient’s, confirmed in real-time.

- Privacy and control: Advanced encryption safeguards data, with customers retaining control over access and information sharing. This streamlined process defines the efficiency and security of Open Banking payment initiation, redefining modern financial interactions.

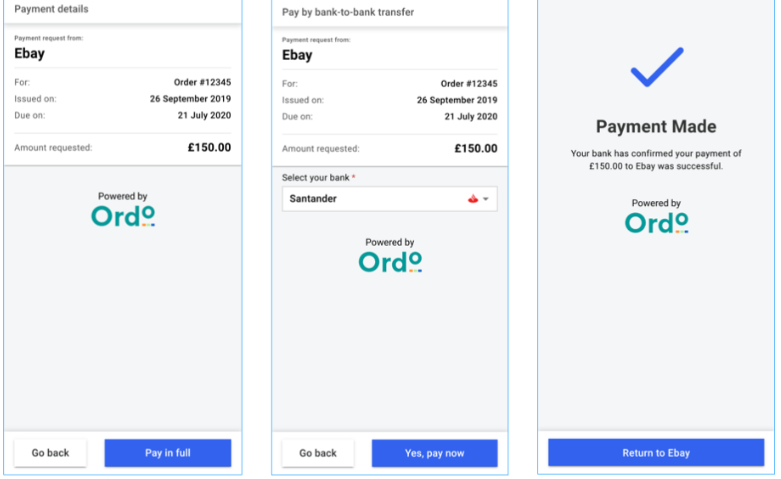

An example of payment flow (white-labelled payer journey):

*In some cases, an extra layer of security may involve generating an authorisation code sent from the bank to the customer’s registered device for an additional layer of security.

API Integration and white-labelled screens: customising Ordo for your business

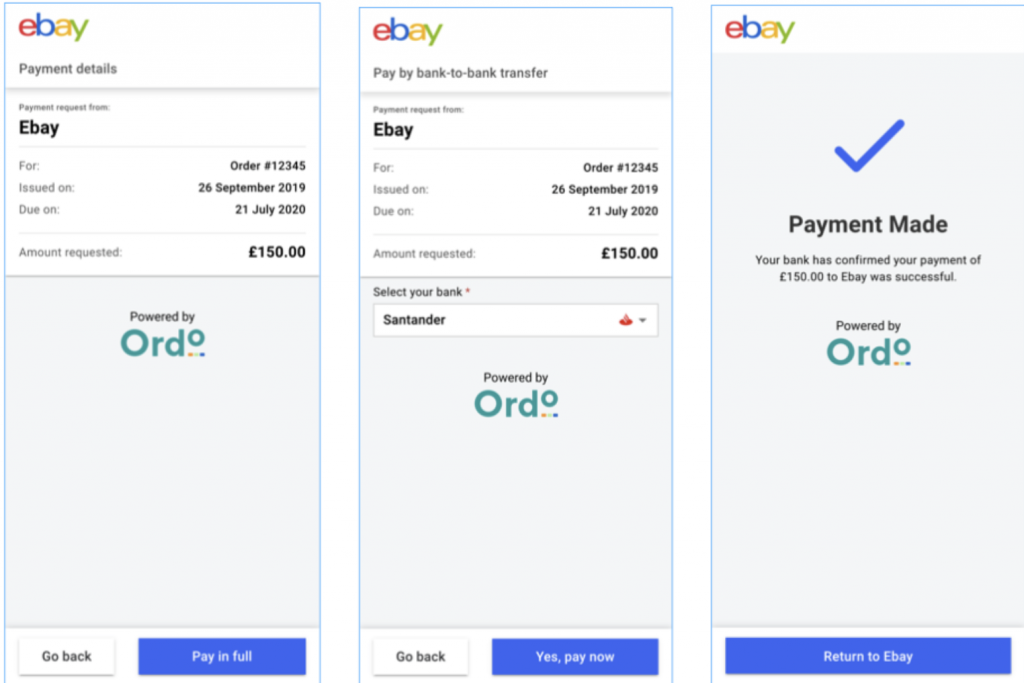

Ordo recognises the importance of customisation for businesses. Through API Integration, companies can tailor Ordo’s solutions to align with their specific requirements. This allows for seamless integration with existing systems and branding elements, ensuring a consistent and personalised customer experience.

Example of a white-labelled payment journey:

Moreover, White-labelled screens enable businesses to present Ordo’s different payment methods options under their own brand, reinforcing brand identity and customer trust. The cohesive branding creates a seamless transition for customers, promoting a sense of familiarity and confidence during the payment process.

Conclusion: unlock hassle-free transactions with Ordo

Ordo presents a comprehensive suite of diverse payment solutions designed to meet the distinct requirements of both businesses and consumers. From employing the Open Banking Payments Platform-as-a-Service as its foundational approach to harnessing the adaptability of Request to Pay, Variable Recurring Payments, and E-Commerce via QR codes, Ordo ensures the execution of seamless and secure transactions.

Whether your business necessitates single or recurring payments, Ordo provides fully hosted managed solutions, including secure tokenized links, Pay Now buttons, and prebuilt payment flows. These solutions can be effortlessly integrated into your existing infrastructure or smoothly implemented as plug-and-play options, such as our Quick Check Out. Furthermore, our single-API Integration and white-labeled Screens offer the customization required to align Ordo with the unique identity of each business.

As digital transactions continue to shape the future of commerce, having access to a wide range of payment methods is crucial for businesses to thrive in the competitive landscape. With Ordo’s innovative solutions, businesses can opt for the payment options that best align with their needs, fostering growth and amplifying customer satisfaction. Step into the future payments with Ordo today!