Bringing our payment platform and Open Banking expertise, together with that of IT and business consulting services firm CGI, making the Managed Credit solution even better, with commission free payments.

We are a pioneer of technological innovation, and with CGI’s near 6,000 consultants worldwide supporting energy retailers to transform operations, drive cost efficiencies and improve the customer experience, Ordo’s payment solutions are the perfect fit. Ordo’s solution, integrated into the Siemens product, allows energy suppliers to securely request payments from customers in real-time, via direct bank-to-bank transfer. This can significantly reduce payment and reconciliation fees on every transaction, generating significant savings for both supplier and customer.

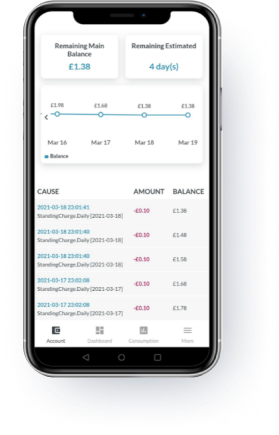

Siemens’ central energy Wallet removes the need for a costly IHD/PPPMID, whilst the single energy balance means fewer top ups, significantly reducing transaction fees for the energy supplier. With greater visibility of energy usage via smartphone or website and in-built top up alerts, customers can self-serve, reducing customer service costs.

Managed Credit makes energy management accessible and user friendly for domestic and small business customers alike. It combines electricity and gas balance in one Central Wallet that can be accessed by a smart phone. Users can configure alerts and automate top ups to help with budgeting and ensure that self-disconnection is minimised.

Ordo offers a range of Open Banking enabled services from no integration app and web functionality; and QuickBooks, Sage and Xero compa bility to full API integra on via simple APIs to suit every large enterprise.

“Ordo has meant we have been able to foster customer relations, supporting our customers when they need us by giving them a solution that’s easy and allows them to stay on top of their finances. We have been able to reduce the burden on our call centre staff working from home, often for the first time, and save costs which we can pass on to our customers”

Head of service delivery, PFP energy, Natalie Brundish

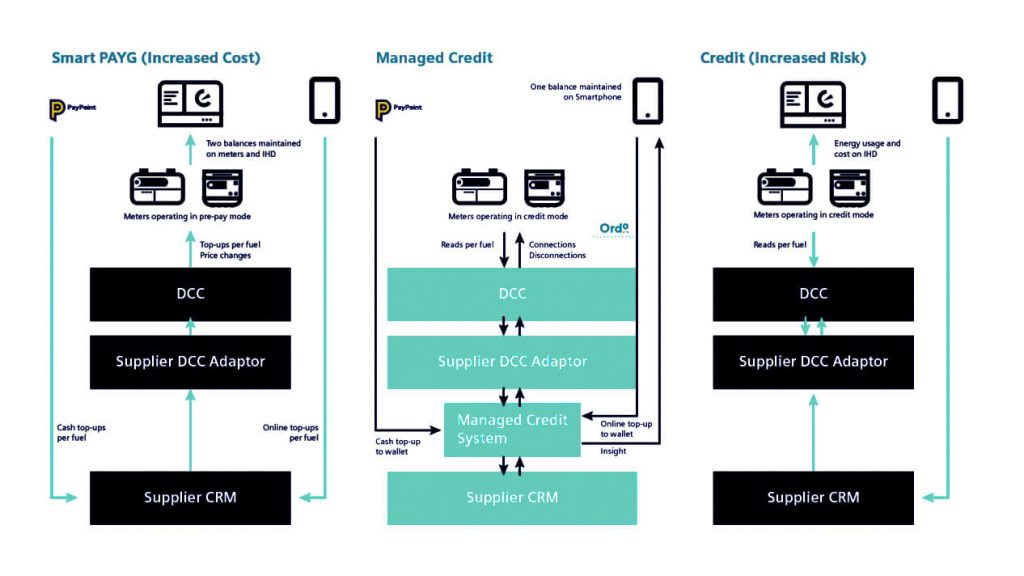

Managed Credit is an excellent opportunity for energy suppliers to build upon their existing standard credit, direct debit and prepayment offers for domestic and small business customers alike.

The solution is highly scalable and can cover both large supplier estates as an alternative to smart prepayment, as well as providing an innovative approach to prepayment for challenger brands.

Making energy management easier for customers.

With scheduled auto top up functions, protecting against self-disconnection.

Through which customers can top up electricity and gas as one payment.

Providing comission-free payments, which generate significant savings for suppliers.

Works with all existing mainstream DCC Adapters.

Particularly helpful for growing energy suppliers.

No card data is collected so no requirement for PCI-DSS compliance, relieving redulatory burden.

Suitable for domestic credit customers, prepayment customers and small businesses.

Managed Credit, complete with commission free Ordo’s Open Banking instant payment capability, is integrated into existing systems to provide data on customer energy usage and daily energy reads to customers

The Managed Credit option, with Ordo integrated, takes daily reads from the customer’s smart meters to update a Central Wallet displayed on their smartphone, allowing for auto top ups and easy to manage payment balance, all at low cost to the supplier. This ensures customers are kept aware of their bills and energy credit, reduces their risk of self-disconnection and limits calls to energy call centres.

The Ordo, Siemens and CGI collaboration means there can now be credit energy without the risk, and prepayment energy without the cost. Contact Ordo for how we can simply integrate our solutions into your systems today.