The benefits of Variable Recurring Payments (VRP)

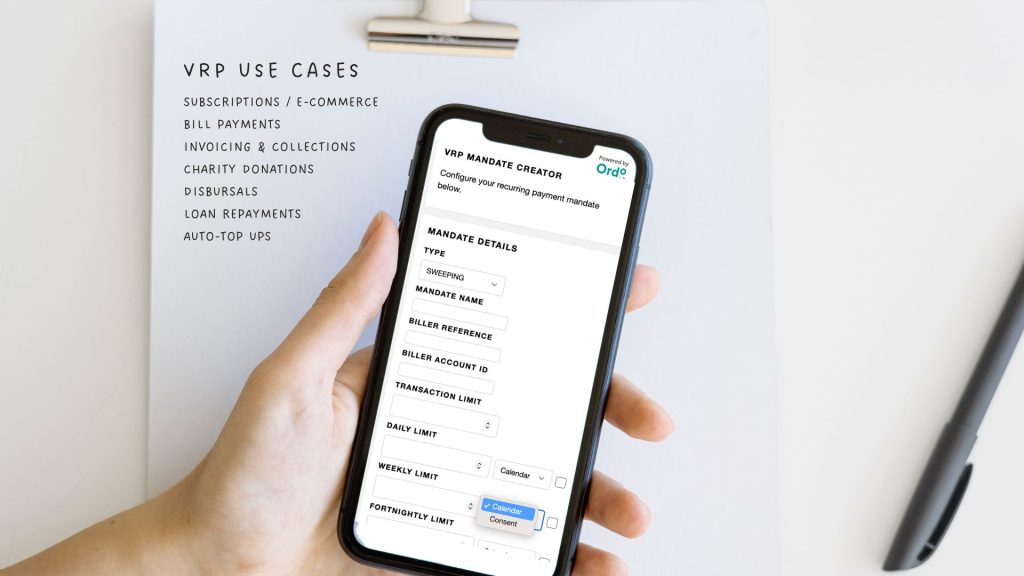

Variable Recurring Payments (VRP) use modernising Open Banking technologies to enhance transaction experiences for businesses and consumers, with several key advantages.

These include flexibility (allowing payments to vary depending on usage), accuracy (charges are more precise, not estimated), customisation (more tailored to individual needs), and adaptability (more responsive to market changes and shifts in consumer behaviour).

The advantages of VRPs include greater customer loyalty as users appreciate that their payments will alter with their consumption, improving perceptions of the service provider.

Reduced churn is another benefit, as consumers can easily adjust their spending patterns in a more flexible relationship with their existing supplier, encouraging retention rather than seeking alternative options.

VRPs also offer enhanced sustainability for usage-based businesses, underpinning a scalable business model with predictable income streams.

The advantages of VRPs also include automation, with billing processes made more streamlined and accurate by established and reliable AI-empowered pricing formulas.

Advantages for businesses

The advantages of VRPs for business extend further, offering enhanced regulatory compliance.

Using financial APIs and Open Banking protocols, businesses can more clearly demonstrate transparency and fairness in their payment processes, increasing consumer confidence and reducing exposure to legal or compliance issues.

Variable Recurring Payments can be tailored to match usage and consumption, ensuring all parties are satisfied with the costs incurred for using a service.

Cash flow is improved, with businesses receiving payments that more closely align with actual consumption rather than fixed payments that may artificially boost or reduce income streams, helping with accurate budgeting and financial forecasting.

In a competitive marketplace, the benefits of Variable Recurring Payments (VRP) for businesses also include customer appreciation of the flexibility offered to settle their invoices in this way.

Retention rates are likely to be enhanced due to VRPs being made available.

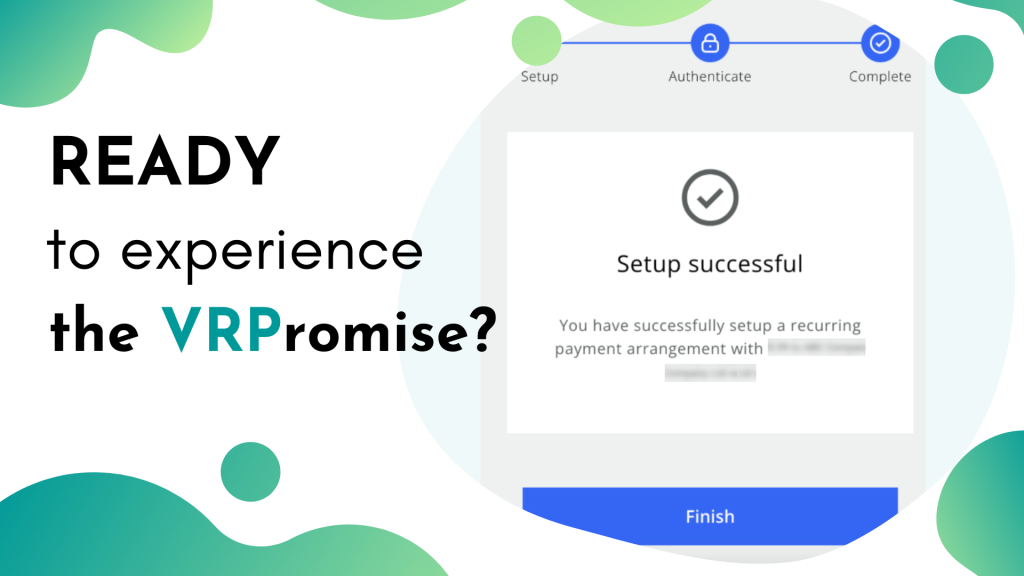

Instant setup: Unlike direct debits, which can be cumbersome and may take days to set up due to the mandate process, VRPs are established within minutes. They allow for the collection of variable amounts under the same agreement with the customer’s consent, while also enabling the collection of ad hoc payments.

Also, the scalability of a business is likely to be improved if VRPs are used to regulate an increasing customer base and smooth out fluctuations in demand, costs, and income.

Benefits for consumers

The benefits of Variable Recurring Payments for consumers are equally wide-ranging.

- Flexible payments: adapting to usage and needs, allowing users to control the costs for specific services

- Ease of use: financial APIs enable automatic payments for repeating transactions, ensuring bills are paid without personal intervention

- Cash flow management: VRPs help customers manage their cash flow more accurately with real-time adjustments to payment plans

- Personalisation: consumers can choose payment dates to suit their personal needs

- Reduced penalties: VRPs significantly reduce the risk of accidental defaults on repeating payments, saving customers overdraft costs

- Better financial planning: Variable Recurring Payments help consumers plan their spending more accurately, analyse spending patterns and make informed choices

The advantages of VRPs for consumers can be summarised as greater control, flexibility, and convenience, as well as responding instantly to changing circumstances and individual needs.

Technological advancements in Variable Recurring Payments

The rapid development of Open Banking has enabled significant technological advances in processing Variable Recurring Payments, focusing on enhancing product flexibility, user experience, information security and regulatory compliance.

As competition in the banking sector increases, business and personal clients can expect further innovations in Variable Recurring Payments using financial APIs.

Fraud prevention is a high priority, with tokenisation increasingly used to augment advanced multi-factor encryption and biometric authentication protocols to reduce risk.

AI-powered algorithms can also analyse spending patterns and consumer trends to forecast payment plans that will more accurately match supply and demand.

Cryptocurrencies continue to have a place in the financial ecosystem, so Variable Recurring Payments are adapting to this increasingly popular payment method with automated blockchain transactions.

Digital mobile wallets and near-field contactless payments allow users to manage payments via their personal mobile devices, leading to a virtually cashless society.

Wrapping up

The VRP uptake is already underway delivering its benefits, and it’s not just about streamlining processes and ticking regulatory boxes. VRPs represent a modern evolution of traditional payment methods like direct debits or standing orders, offering a modern alternative with unparalleled flexibility, faster transactions, and enhanced security enshrined in the Payment Services Directive 2 (PSD2).

Consumers and businesses are already embracing this shift, recognising the power of swifter, more flexible, and more secure payments. With widespread adoption across all payment types expected by Q3 2024, with the rollout of VRP non-sweeping, this advancement marks just the beginning of an era of endless innovation, with VRPs poised to become the new standard in payment solutions.

The VRP era is here, rewriting the rules of money.

Have questions? Our team is here to answer them.