Accelerating Wealth Creation – Streamlining client onboarding for enhanced financial growth

In our swiftly evolving digital landscape, where customers demand seamless payment experiences, businesses must adapt and innovate to outshine the competition. A critical factor in achieving success lies in facilitating wealth creation. Through harnessing next generation technologies and embracing streamlined payment solutions, businesses can empower their clients, expedite wealth generation, and elevate payment experiences right from the start.

In this blog post, we will explore how payment initiation services, one-click ecommerce, online payment solutions, Open Banking as a Service, immediate payments, automated payments, online payments, and automatic bank transfers can transform the client onboarding experience and supercharge wealth creation.

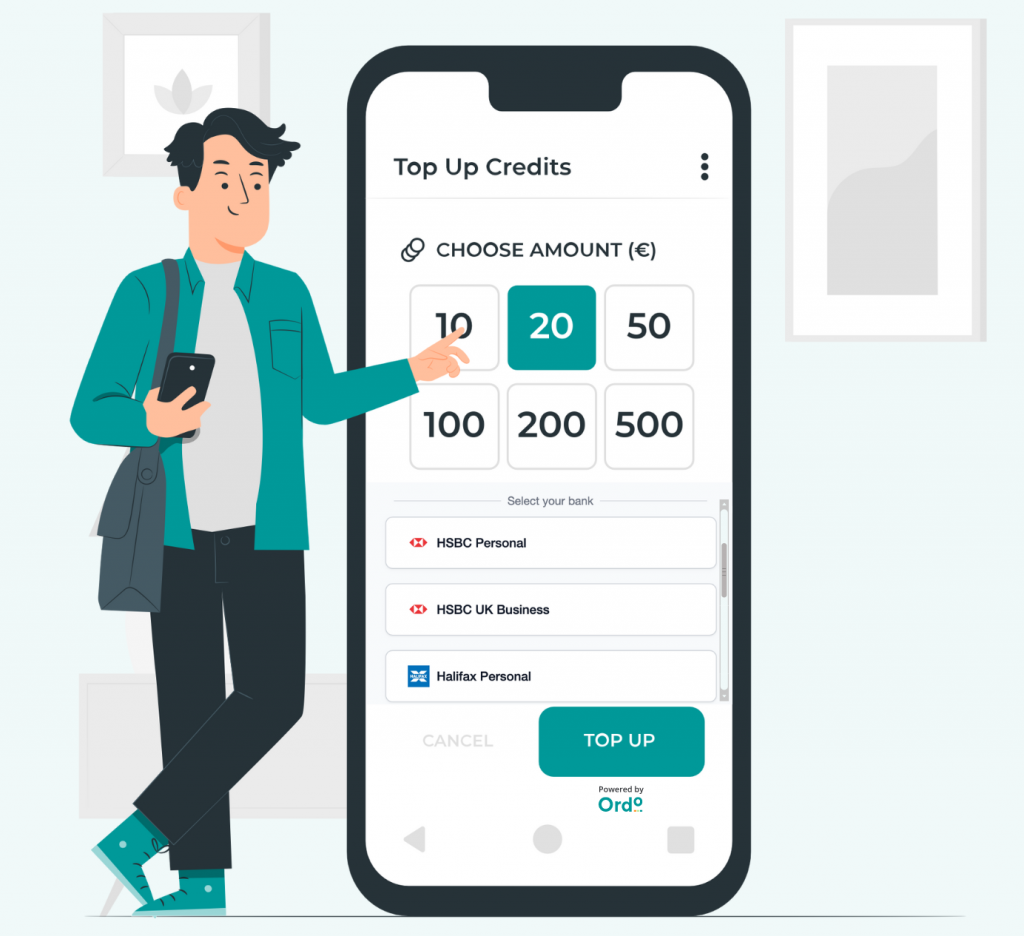

Payment initiation services have revolutionised the way transactions are conducted in the modern era. By integrating payment initiation services into their platforms, businesses can facilitate seamless and secure transactions for their clients. With a simple click, customers can initiate payments directly from their bank accounts, eliminating the need for cumbersome card details or manual transfers. This frictionless payment experience enhances convenience, allowing clients to focus on their wealth creation goals instead of worrying about tedious payment processes.

One-click ecommerce is another game-changing innovation that empowers both businesses and clients alike. By implementing one-click purchasing capabilities, companies can dramatically reduce the time it takes for clients to complete transactions. With just a single click, customers can initiate payments and finalise their purchases, making the entire process effortless and efficient. This streamlined experience not only enhances customer satisfaction but also enables businesses to capture more sales opportunities, further fuelling wealth creation.

To unlock the full potential of wealth creation, online payment solutions play a vital role. These solutions provide businesses with the tools and infrastructure necessary to accept payments securely and seamlessly through various channels. Whether it’s an e-commerce website, a mobile app, or even a social media platform, online payment solutions enable clients to complete transactions from anywhere at any time. By providing this flexibility and convenience, businesses can attract a wider client base and maximise their revenue streams, ultimately boosting wealth creation opportunities for both parties involved.

Open Banking as a Service has emerged as a transformative concept that empowers businesses to offer enhanced financial services to their clients. Leveraging the power of open banking APIs, enable companies to access real-time financial data securely and provide personalised solutions based on individual client needs. This level of customisation enables businesses to offer tailored wealth creation strategies, ensuring that clients receive the most relevant and effective guidance. Open Banking as a Service not only facilitates faster client onboarding but also promotes transparency, trust, and collaboration between businesses and their clients.

Immediate payments and automated payments are two key components that can revolutionise the wealth creation journey:

Immediate payments enable clients to access their funds instantly, eliminating the traditional delays associated with bank transfers. This speed ensures that clients can capitalise on investment opportunities promptly, ultimately maximising their wealth creation potential. Automated payments, on the other hand, simplify recurring transactions by setting up automatic bank transfers. This not only reduces the administrative burden for clients but also helps them stay consistent with their wealth creation plans, ensuring regular contributions or investments are made without any manual intervention.

Online payments have become the norm in today’s digital age, offering convenience and efficiency for businesses and clients alike. By incorporating secure online payment gateways, businesses can accept a wide range of payment methods and facilitate smooth transactions. Whether it’s credit cards, debit cards, digital wallets, or even cryptocurrencies, online payment solutions provide clients with flexibility and choice. This flexibility encourages clients to engage more actively in wealth creation activities, as they have the freedom to utilise their preferred payment methods and access investment opportunities seamlessly.

Automation has become a game-changer for businesses seeking to streamline their operations. By automating payment processes, businesses can eliminate manual tasks, reduce errors, and free up valuable resources. Automatic bank transfers, for instance, enable businesses to schedule recurring payments, ensuring timely settlements for subscriptions, memberships, and other regular transactions. This automation not only saves time but also minimises the risk of late or missed payments, improving overall efficiency and customer satisfaction.

In today’s digital age, businesses need to leverage cutting-edge technologies and innovative payment solutions to empower wealth creation. Faster client onboarding, enabled by payment initiation services, one-click e-commerce, online payment solutions, and Open Banking as a Service, is crucial for businesses seeking to stay competitive and deliver exceptional customer experiences. With these easy-to-integrate tools, businesses can enjoy immediate, automated, and secure transactions, including online payments and automatic bank transfers. The result is enhanced operational efficiency, increased revenue, and the ability to seize new opportunities in the dynamic world of finance. Embrace the power of faster client onboarding and unlock the true potential of your business in the digital era with a free demo.